Time:2024-04-09 Click:164

撰文:付和火、Odaily星球日报

作为全球最大的资产管理公司,贝莱德在年初成功推出了比特币现货ETF,筹集了超过130亿美元的资金,目前已跻身顶级比特币现货ETF行列,比特币持有总量仅次于灰度。比特币现货ETF的成功让贝莱德能够继续专注于加密行业。

3月20日,贝莱德宣布与Securitize合作推出代币化资产基金贝莱德美元机构数字流动性基金(BUIDL)。推出仅一周后,就成功吸引了超过2.4亿美元的资金。其中,著名的RWA项目Ondo也参与其中。

贝莱德宣布推出代币化基金BUIDL后,根据CoinGecko相关数据显示,加密市场中RWA相关发币项目出现大幅增长,其中Ondo项目代币ONDO涨幅超过130%, XDC Network项目代币XDC涨幅超过28.5%。

为什么贝莱德旗下代币化基金BUIDL的推出对RWA行业有如此显着的推动作用?

为此,Odaily星球日报将介绍BUIDL的概况、上线以来的相关进展以及对未来RWA领域的影响。

贝莱德代币化基金BUIDL概述及近期动态

代币化基金BUIDL由BlackRock和Securitize基于以太坊发行,并由BlackRock Financial Management, Inc.运营和管理。BUIDL主要投资于现金、美国国债和回购协议。基金投资者必须符合“合格投资者”资格。投资者将获得等值的BUIDL代币,每个BUIDL代币价值1美元。代币将通过Securitize的加密钱包转移到其他经过验证的地址,但投资者转移BUIDL代币,接收者必须满足其审核条件。

该基金合伙人Securitize创始人兼首席执行官Carlos Domingo认为,代币化基金BUIDL主要服务于三个用例。

值得注意的是,持有贝莱德美元机构基金所赚取的收入并未在美国证券交易委员会(SEC)注册。因此,质押BUILD产生的利息可能不会在任何加密货币交易平台上列出。多明戈回应称,SEC尚未发布任何关于区块链代币化的相关建议。

At present, the BUIDL fund has been launched for nearly a month. According to 21.co’s data analysis on Dune, the BUIDL fund has attracted US$286.35 million, only lower than BENJI, a tokenized fund based on the Stellar chain launched by FOBXX.

As can be seen from the above figure, Ondo Finance also holds $198 million in the tokenized U.S. bond market, ranking third in market share. It is worth mentioning that less than a week after BlackRock launched the tokenized fund BUIDL, Ondo Finance announced an investment of more than $95 million, accounting for more than 33% of the BUIDL fund shares, and is currently the largest holder of the BUIDL fund.

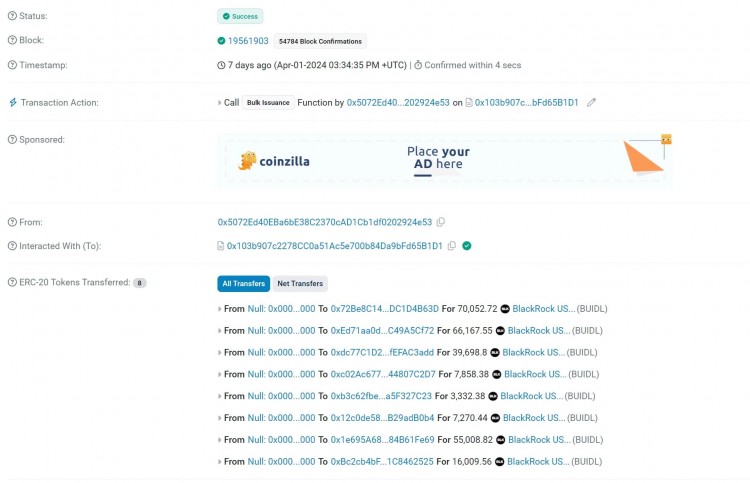

According to the transaction records of the block browser, on April 1, the tokenized fund BUIDL made its first dividend payment to 8 investors, among which Ondo address 0x 7 2B... 6 3D received more than 70,000 BUIDL tokens.

Subsequently, according to the transaction records of the Ondo on-chain address, on April 3, Ondo Finance allegedly conducted the first redemption test on the BUIDL fund, transferring 250,000 BUIDL tokens to the Securitize address 0x 878…200, and then transferred them into the black hole through this address for destruction.

Since the issuance of the BUIDL Fund, most of the fund's operating procedures have been completed, including issuance, dividend distribution, and repurchase. Although the official annualized rate of return of the BUIDL Fund has not been marked, it is speculated based on the amount and time of its dividend distribution that the APY is about 5.3%, which exceeds the yield of most RWA projects' US Treasury products.

ONDO may become the "last chance" for most investors in the RWA sector

The RWA sector has been gaining popularity since last year, with more and more people discussing RWA at many Web3 industry summits. However, compared with foreign communities, the Chinese community has not responded much to this. The most important point is that most RWA project products have restrictions on Chinese investors. From a certain perspective, buying RWA products is not easier than buying U.S. stocks in reality.

However, will the RWA sector, which may reach trillions in the future, be out of reach for ordinary retail investors? Odaily analyzed the launch of the tokenized fund BUIDL by BlackRock this time, and ONDO tokens may become one of the few targets for most retail investors who cannot buy RWA products to participate in the RWA wave.

In the past, most RWA projects used to establish independent SPVs to manage user investment funds, but both purchase and redemption required certain time limits, which was not conducive to attracting most Web3 investors. However, BlackRock’s launch of the tokenized fund BUIDL has opened a door to connect traditional finance and Web3 to a certain extent, but this is not for investors, but for most RWA projects.

根据贝莱德BUIDL的运营规则,投资者投资该基金后,将获得等量的BUIDL代币和每日分红,并在条件允许时可以转让。此举优化了RWA项目复杂的申购和赎回机制。 Ondo Finance也在发行不到一周后将OUSG(代币化美国国债)的大部分基础资产替换为BUIDL。

另外,可以参考Odaily此前对Ondo Finance的详细解读文章:转型成功,TVL跃升至RWA赛道前三。虽然ONDO本轮已经有了相当大的涨幅,但ONDO代币是在转型之前发行的,本质上与当前的RWA关系不大。 ONDO代币已经满足了相关的叙述,并且仍然有增长的空间。作为目前RWA领域的领军者,ONDO代币的崛起也在一定程度上标志着RWA领域的发展。结合大部分被RWA产品拒绝的投资者心理,Ondo Finance或许成为“最后的机会”。