Time:2024-03-22 Click:206

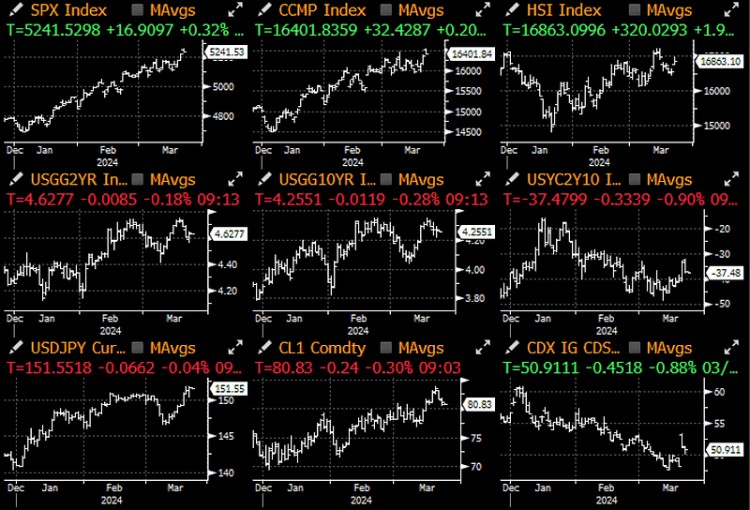

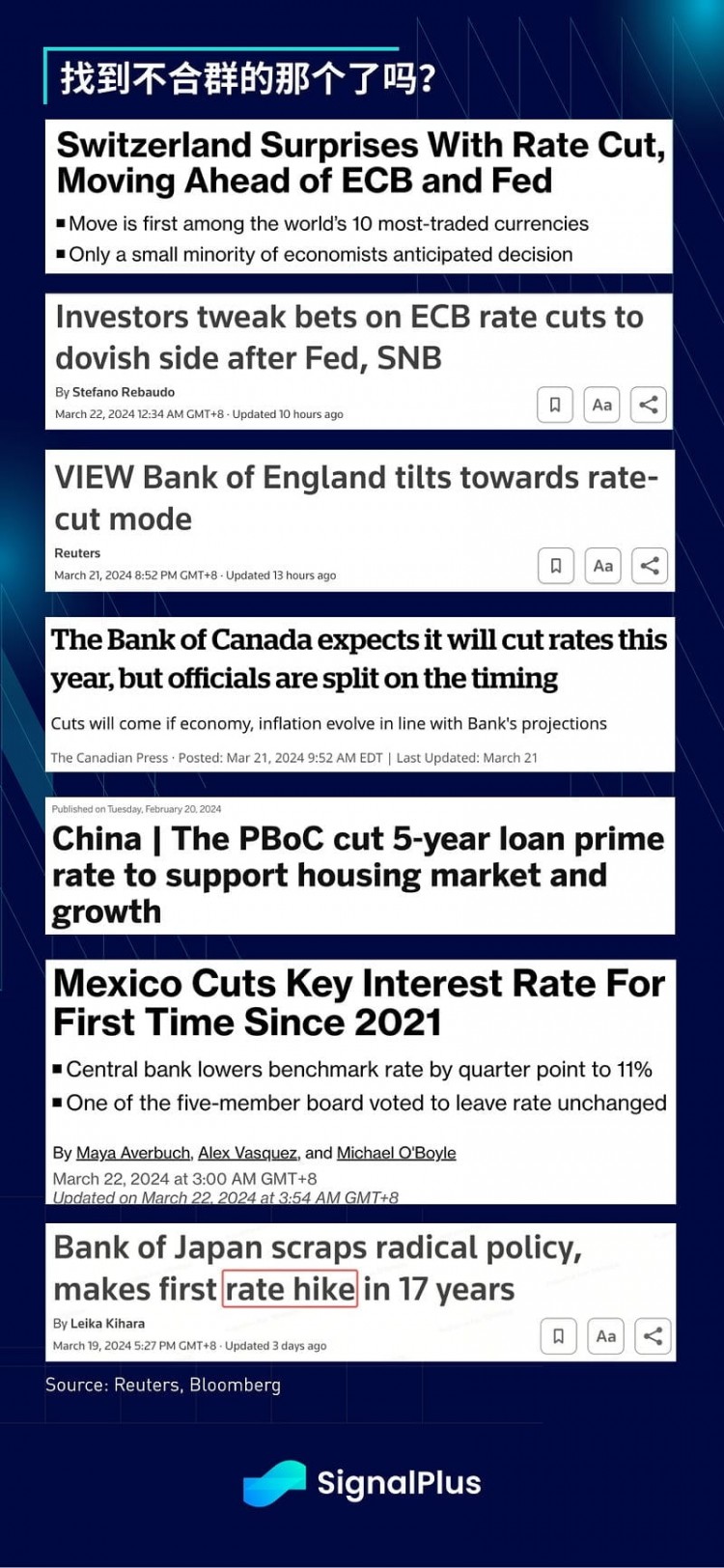

The Swiss National Bank unexpectedly became the first major central bank to cut interest rates after the Federal Reserve expressed its dovish stance yesterday, which could mark the beginning of a rate-cutting year for developed economies. The Bank of England followed closely behind and achieved its own "dovish maintenance" with an 8-1 vote. The committee expected CPI to be "slightly weaker" than expected, and the possibility of the Bank of England cutting interest rates in June also increased from 65% to 65%. 80%. The probability of the European Central Bank cutting interest rates in June is also close to 80% after the Federal Reserve, Bank of England and Swiss National Bank issued their stances, while the Bank of Canada and the People's Bank of China are also clearly leaning towards accommodative stances given weak economic growth.

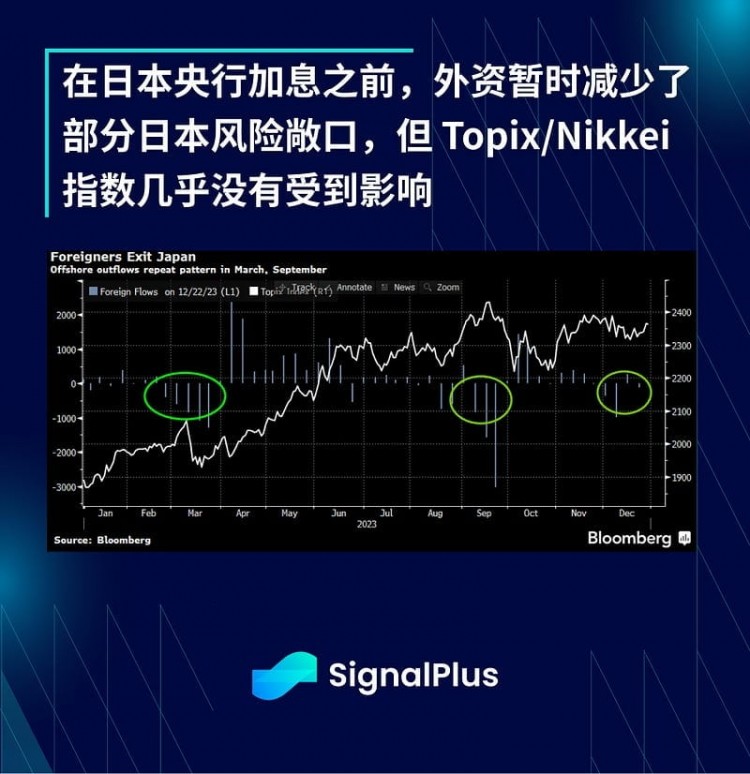

Japan, on the other hand, remains a maverick as the only central bank to raise interest rates in the current cycle, with its stock market, housing market and wage growth outperforming most of its peers. Interestingly, while foreign direct investment and foreign capital inflows have been the main driver of the market over the past 18 months, foreign investors sold a large number of stocks in December due to concerns about the Bank of Japan exiting its negative interest rate policy. However, TOPIX/ The Nikkei index was barely affected and continued to hit new highs around the time the Bank of Japan raised interest rates. In fact, a similar situation occurred in September. When signs of policy changes emerged, foreign capital outflows accelerated. However, in October, the situation took a 180-degree reversal. The market was not affected. A similar pattern will repeat itself in the near future. ?

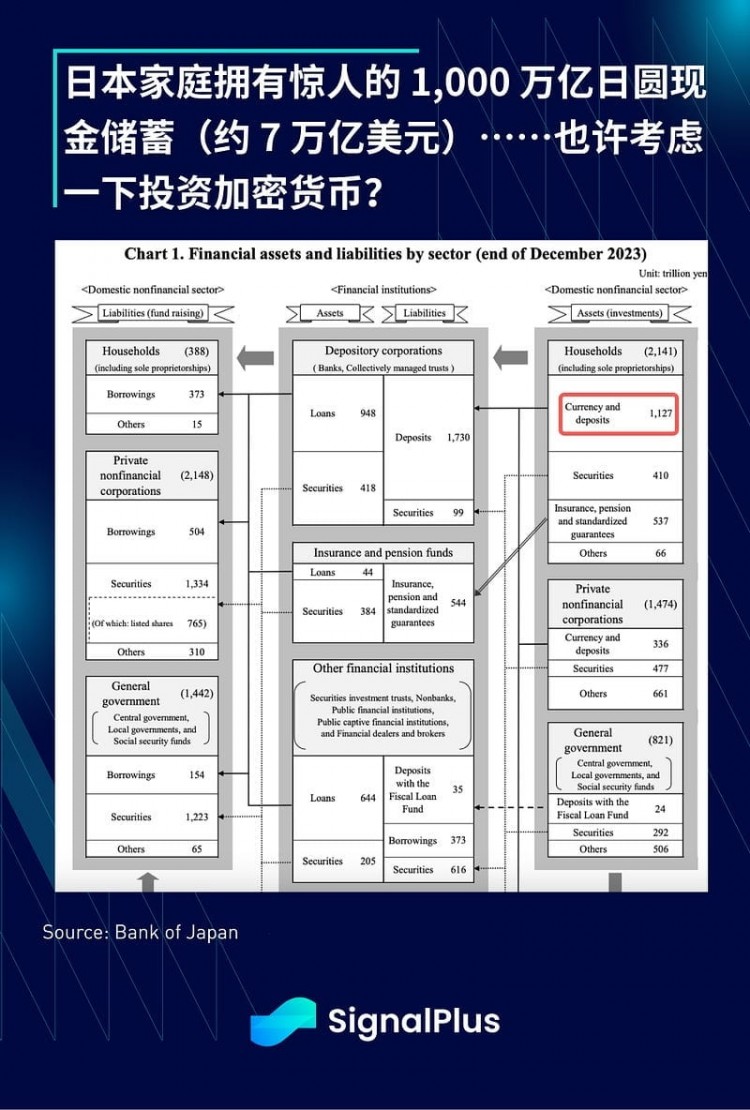

In addition, the latest currency survey from the Bank of Japan also revealed some interesting information. Japanese households hold a staggering 1,000 trillion yen (approximately US$7 trillion) in cash and savings accounts, accounting for approximately 53% of household financial assets. Much higher than the United States (13%) and Europe (36%). In addition, the value of stock investments by middle-income households has increased by about 30% annually, and 1/10 households have received more than 6 million yen in income through capital gains, which is equivalent to the annual household income. What will they do with their $7 trillion cash surplus as attitudes finally change about investing in stocks, buying real estate, wage inflation (the largest union wage increase in 33 years), an exit from negative interest rate policies, and continued generational wealth transfers? Will be one of the most important macro narratives in the coming years, is it possible that they will develop an interest in cryptocurrency diversification?

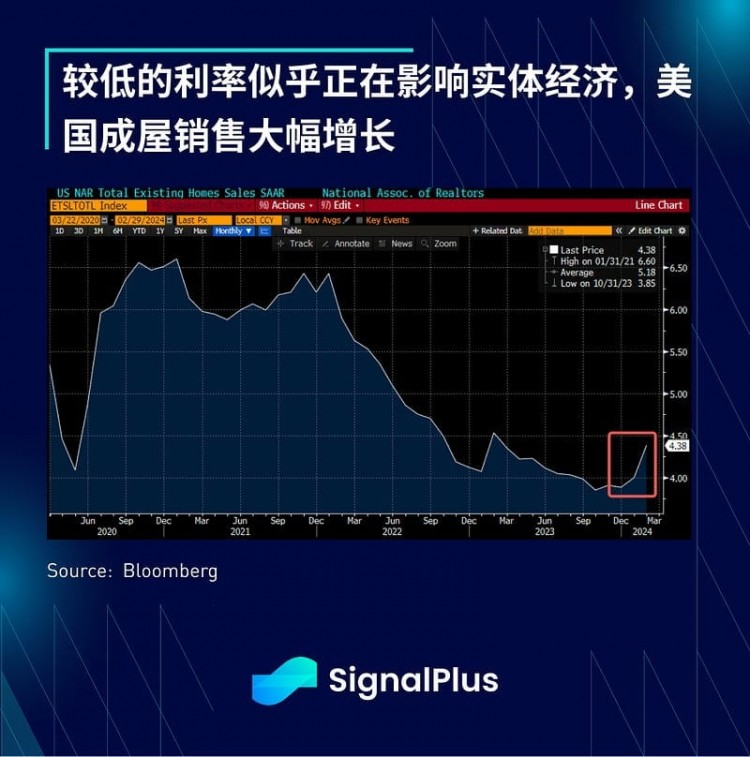

Back in the US, the stock market is rising to new highs as usual (thanks, Fed!). Economic data shows that lower mortgage rates seem to be smoothly affecting the real economy, with a sharp increase in existing home sales. In addition to the strong overall data, housing supply and median prices (up 0.5% month-on-month) also showed good growth, returning to pre-epidemic levels. It is expected that the Fed's interest rate cuts will further boost demand in the second half of the year.

In the stock market, the S&P 500 index rose for four consecutive days and hit another record high. Although Apple's stock price fell 4% as the U.S. Department of Justice sued iPhone for violating antitrust laws, it did not affect the index's rise. On the other hand, as investors are optimistic about its vision of providing large amounts of training data for AI models, Reddit's stock price soared more than 67% from the issue price on the first day of listing, and finally closed up 48%. The success of this IPO may be a sign of success. The doors opened to a flood of private companies hoping to go public amid high market sentiment.

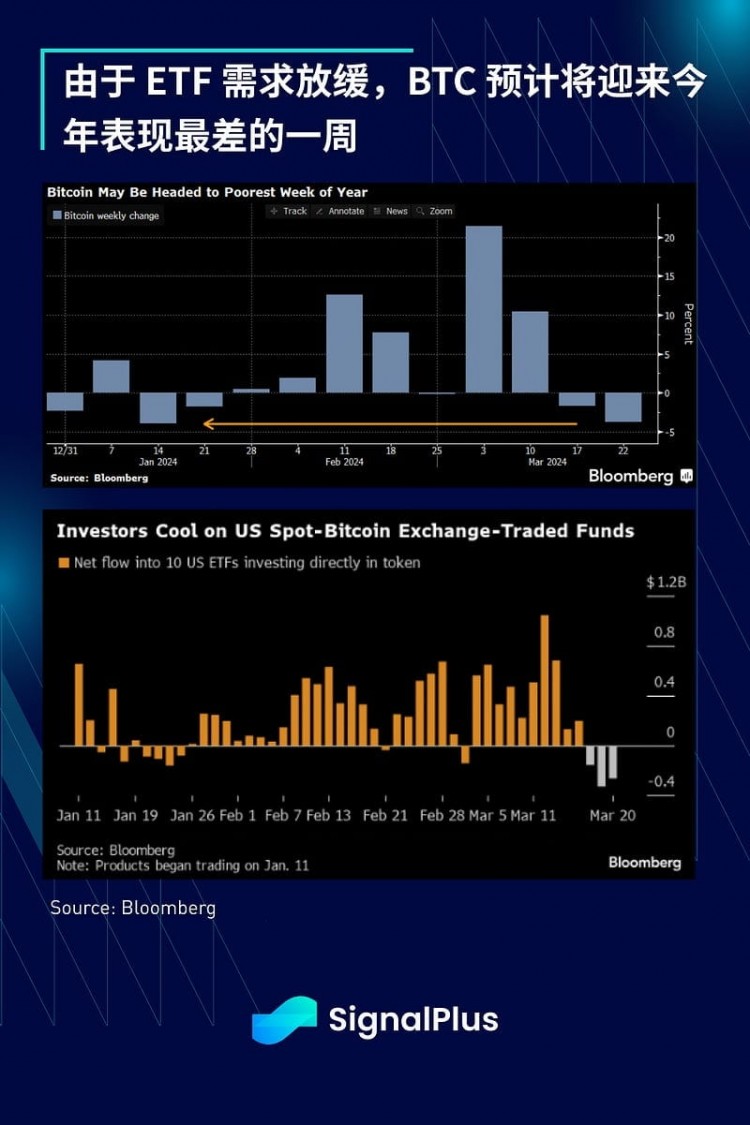

On the cryptocurrency front, the market tone was slightly gloomier as BTC headed for its worst week of the year as ETF demand slowed. After setting a series of single-day record inflows in mid-March, the BTC ETF’s net inflows have turned significantly negative over the past 3–4 days, while BTC price momentum has slowed, leaving BTC barely holding above $65,000.

In addition, the U.S. SEC may return to its old model. Forbes reported that the Ethereum Foundation is facing a confidential inquiry from an unnamed "national authority." The developer stated in the commit submitted on GitHub, "This commit removes the footer. "In part, because we received voluntary inquiries from national authorities and were asked to keep them confidential," and a statement was removed from the website stating that the Foundation has never been contacted confidentially by any national agency around the world.

The confidential inquiry comes at a delicate time, with signs that the ETH ETF may not receive SEC approval in May as the agency still insists that ETH is a security. ETH prices have fallen, and Grayscale Trust’s ETH The discount also widened from -10% to -18%.

All in all, the recent mania in the cryptocurrency space appears to have subsided, and we may see the market move sideways in the coming days as the market regains its footing.