Time:2024-11-21 Click:601

本周热门话题

Clover Finance ($CLV) 最近公布了 CLV 2.0 升级版。此次升级的路线图包括在其去中心化交易所 (DEX) 流动性平台上推出自动做市商 (AMM)、允许其他项目在 CLV 网络上创建新代币的代币启动程序、SocialFi 集成以及 ERC20 代币的升级和迁移。该公告引起了投资者的极大兴趣,导致其价值在短短一周内大幅上涨了 271.5%。这一价格走势表明投资者对此次升级将对 CLV 生态系统产生的积极影响充满信心。

Secret ($SCRT) 是致力于去中心化机密计算的 Layer 1 区块链。其价格近期上涨凸显了全球对以隐私为中心的区块链解决方案的需求日益增长,Secret 基金会将这一趋势归因于其创新发展,尤其是 NewDeCC(去中心化机密计算)计划。

一份报告显示,当选总统特朗普正在考虑任命加密货币律师 Teresa Goody Guillén 为 SEC 主席,这表明特朗普对加密货币行业持支持态度。在这种乐观的背景下,SEC 审查过的一系列货币和代币的价格大幅上涨,原因是人们希望新任 SEC 主席能减轻现有的指控和调查。此外,市场预计潜在的新 ETF 申请将在更短的时间内获得批准。值得注意的是,受此消息影响,Hedera ($HBAR) 和 Ripple ($XRP) 的价格分别飙升了 109.1% 和 60.4%。

整体市场

上图是BTC日K线图。

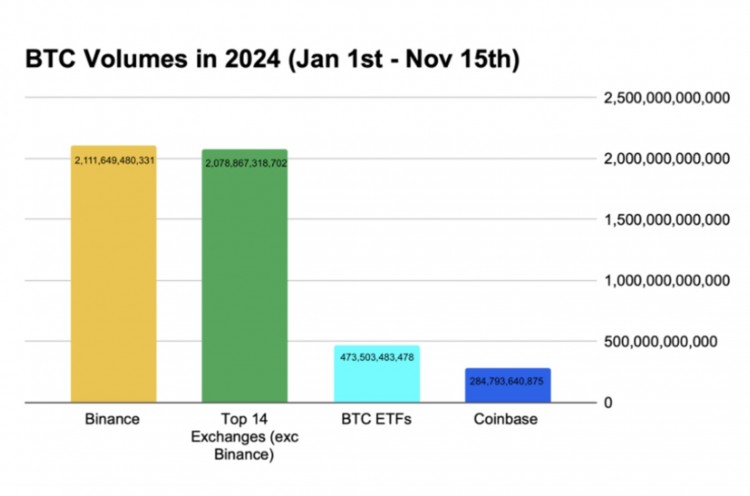

在最近的美国大选日之后,比特币 (BTC) 继续保持其令人印象深刻的上升轨迹,在撰写本文时创下了 95,895 USDT 的历史新高。价值的激增可以归因于多种因素,最显着的是来自交易所交易基金 (ETF) 领域的大量资本流入。此外,将比特币纳入资产负债表的上市公司数量显着增加,进一步使加密货币成为可行的资产类别。

One of the standout players in this landscape is MicroStrategy, a publicly traded firm led by the outspoken Bitcoin advocate Michael Saylor. Since November 5, the day of the US elections, MicroStrategy's stock price has skyrocketed by over 110%. During the same period, Bitcoin itself has experienced a substantial rise of approximately 40%. This dramatic increase in MicroStrategy's share price reflects a robust investor appetite for leveraged exposure to Bitcoin. The company's strategic approach involves accumulating and holding Bitcoin on its balance sheet, which tends to drive up its stock price as the value of BTC appreciates. Furthermore, MicroStrategy has actively engaged in share offerings to raise capital specifically to acquire more Bitcoin. As the price of Bitcoin continues to ascend, this buy-and-hold strategy is likely to create a positive feedback loop, further enhancing the stock price and encouraging additional Bitcoin purchases.

However, MicroStrategy's buy-and-hold approach is no longer the only avenue available for investors and traders seeking leveraged exposure to Bitcoin. The recent introduction of options trading on BlackRock’s IBIT, the largest Bitcoin spot ETF by assets under management, on the Nasdaq exchange, has opened up new possibilities for investors. This development allows investors to leverage derivatives to gain enhanced exposure to Bitcoin, providing them with more tools to manage their investments. The availability of Bitcoin ETF options not only broadens the investment landscape but also enables investors to optimize their yields, leading to more accurate return expectations. As a result, this innovation is anticipated to attract increased market interest and capital into Bitcoin, which will, in turn, benefit the broader cryptocurrency sector.Options Market

The above is the 25-delta skew table for BTC and ETH options.

As the rally in Bitcoin (BTC) prices continues to gain momentum, the prevailing bullish sentiment surrounding BTC remains robust. This is particularly evident in the options market, where the 25-delta skew for BTC options set to expire in seven days is currently reflecting a premium of 3.74. This premium indicates that traders are willing to pay more for upside potentials on BTC, suggesting a strong belief in its potential for further price appreciation. In stark contrast, Ethereum (ETH) options with the same expiration date show a much lower premium of 2.84. This discrepancy highlights a notable difference in investor sentiment, with a clear preference for BTC over ETH at this time.

Moreover, the data reveals that the bullish outlook for medium- to long-term options is even more pronounced for BTC compared to ETH. This trend may be largely attributed to the recent underperformance of ETH in the market. While BTC has successfully reached multiple new all-time highs, ETH is struggling to maintain its value, currently trading below the $3,100 mark. This is a stark contrast to its previous peak of $4,868, which it achieved three years ago. The significant gap between ETH's current price and its historical high may be contributing to the more cautious sentiment among investors regarding ETH's future performance.

Our analysis indicates that market attention is likely to remain heavily focused on BTC in the upcoming weeks. Given the current bullish sentiment and the potential for further upward movement, it seems plausible that BTC could continue to attract investor interest and capital. This could lead to additional price gains before any significant shift in market sentiment occurs. The 25-delta skew serves as a valuable tool for gauging market sentiment, providing insights into how traders are positioning themselves about potential price movements. As such, it will be important for investors to monitor these indicators closely better to understand the evolving dynamics of the cryptocurrency market.Macro at a glance

Last Thursday (24-11-14)

Initial jobless claims in the US have declined, falling from 221,000 last week to 217,000 this week, below the anticipated 224,000. This strong performance in the US labour market reinforces the Federal Reserve's cautious approach to potential rate cuts in the coming year.

In October, the Producer Price Index (PPI) experienced a monthly increase of 0.2%, slightly above the 0.1% growth recorded in September. The core PPI rose by 0.3% month-over-month, surpassing September's 0.2% increase. These PPI figures indicate upward pressure on inflation in the US and support a more gradual approach to rate cuts by the Federal Reserve in the coming months.

Last Friday (24-11-15)

Japan's GDP growth for the third quarter stands at 0.9%, surpassing economists' expectations of 0.7%. However, the growth rate for the second quarter has been revised down from 2.9% to 2.2%.

In the UK, the annual GDP growth rate for Q3 is reported at 1.0%, significantly exceeding the anticipated 0.1% and showing an improvement from the 0.7% growth recorded in Q2.

In the United States, retail sales experienced a monthly increase of 0.4% in October, outperforming the forecast of 0.3%. The figure for September has also been adjusted upward from 0.4% to 0.8%. However, core retail sales only registered a 0.1% monthly growth, falling short of the expected 0.3%, with September's figure revised from 0.5% to 1.0%.

On Tuesday (24-11-19)

欧元区10月份CPI环比增长0.3%,较9月份下降0.1%有所回升;年率CPI增长率与9月份持平,为2.0%,核心CPI增长率也维持在2.7%。

加拿大10月份CPI环比上涨0.4%,较9月份下降0.4%有所回升。核心CPI同样上涨0.4%。

英国10月CPI环比上涨0.6%,9月为0.0%;年率上涨2.3%,超过10月预期的2.2%,且较9月的1.7%有所回升。

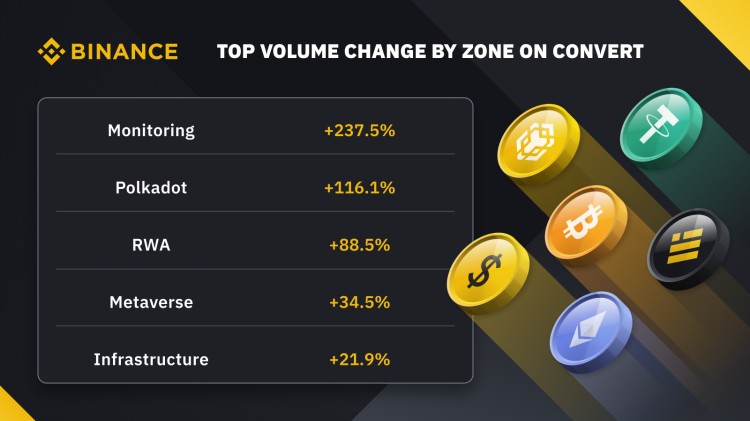

转换门户体积变化

上表显示了我们的转换门户上各区域的成交量变化。

BTC在美国大选日后迅速上涨,随后逐步走高,而山寨币在过去一周表现也十分抢眼,随着大盘山寨币的上涨,我们团队注意到中小盘山寨币也开始受到更多交易者的关注。

在监控板块,交易量的大幅增长可以归因于 Clover Finance ($CLV) 周围的异常活跃。对 CLV 代币的强劲需求导致监控区内的交易量在过去一周内增长了 237.5%。

Polkadot 领域的交易量增长了 116.1%,这主要得益于人们对 Acala ($ACA) 的兴趣高涨。

此外,RWA 领域的交易活动显著增加 88.5%,其中 MANTRA ($OM) 引起了市场极大兴趣,价格大幅上涨。

为什么要进行场外交易?

币安为客户提供多种方式进行场外交易,包括聊天沟通渠道和币安场外交易平台(https://www.binance.com/en/otc)进行手动报价、算法订单或通过币安转换和大宗交易平台(https://www.binance.com/en/convert)和币安转换场外交易 API 进行自动报价。

undefined