Time:2024-06-10 Click:162

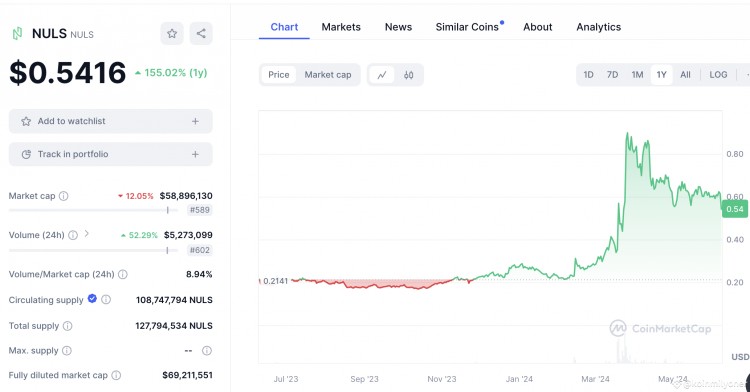

某些加密货币获得了巨大的收益,而其他加密货币则遭受了巨大的损失。本文探讨了几种目前值得考虑的加密货币。 1. NULS NULS 既是一个全球开源社区区块链计划,也是一个提供可定制服务的区块链基础设施。 利用微服务设计,NULS 将区块链划分为几个更小、更易于管理的服务。因此,程序员可以更新和修改单个应用程序,而不会影响整个系统。 您可以在 Chain Factory(开发人员可以安装的插件)的帮助下构建和个性化自己的区块链。借助 Chain Factory,可以轻松开发新的区块链并将其集成到 NULS 生态系统中。 共识机制、多链系统和跨链通信只是可以与区块链集成的 NULS 模块中的一小部分。这些模块可以根据您公司的独特需求进行定制。NULS 用户和开发人员的全球社区是推动项目开发和治理的引擎。该平台将以这种方式适应用户的需求和输入。 NULS 网络的原生代币 NULS 用于奖励成员、资助生态系统发展和支付交易成本。 与其他区块链通信的能力是 NULS 的一个关键特性,这增加了其灵活性并促进了与其他网络的通信。 根据提供的摘录,NULS 50 天简单移动平均线似乎在 0.633234 美元左右;然而,100 天 SMA 没有具体说明。然而,考虑到总体趋势,我们可以得出结论,100 天简单移动平均线肯定大于 50 天 SMA。

2. Aave (AAVE)When it comes to crypto lending and borrowing, Aave is a trailblazing decentralized lending system. Aave uses a peer-to-peer (P2P) paradigm to facilitate these monetary transactions directly between users, cutting out middlemen like banks. As a medium of exchange for transaction fees and a medium of governance, the AAVE token plays a crucial role in the ecosystem. Voting on suggestions for protocol modifications or new asset additions gives token holders a say in the project's trajectory.The staking feature, which allows users can receive incentives by staking their tokens, was just implemented by Aave. Users are allowed to partake in the platform's revenue using this function. The current state of AAVE's market performance is indicative of both growth and stability. An index value of 74 on the Fear & Greed scale highlights the optimistic mood. Prices might skyrocket if Aave teams up with other regimens, according to analysts.Take a look at the Aave price chart on coinmarketcap.Over the last week, AAVE's price has increased by 7.93%, reaching a current level of $104.35. Its current price action suggests a bullish market trend, since it is trading higher than the 200-day simple moving average. The market capitalization of AAVE indicates a good amount of trading activity, which is a measure of its liquidity.

3. Arbitrum (ARB)An unique alternative currency, Arbitrum, allows current Ethereum decentralized apps (DApps) to function without modifying code as it accepts unmodified Ethereum Virtual Machine (EVM) contracts. The platform can process hundreds of transactions per second with lightning speed finality and minimal costs, all while preserving the security of Ethereum.By off-chaining the majority of processing and storage, Arbitrum improves Ethereum's speed, scalability, and cost-efficiency via the use of optimistic rollups, which leverage Ethereum's security while providing increased throughput and decreased costs. Members of the Security Council, protocol updates, and cash distribution are all up for grabs with ARB tokens.Staking ARB tokens is an active process that a decentralized network of validators does to secure the network and empower token holders via fee distribution. A decentralized and robust ecosystem may flourish thanks to this approach, which does away with the need for a central operator.ARB's current price is $1.17. The token has climbed by 11% in the previous month, despite a small 3% growth over the past year. It is trading at a premium of 10.70% above the $1.03856 200-day simple moving average. The coin seems to be overbought based on its 14-day Relative Strength Index (RSI) reading of 71.26. With a volume-to-market cap ratio of 0.4348 and 15 green days over the previous 30 days, ARB has maintained excellent liquidity and sustained investor interest. The volatility rate was 6%.

4. InjectiveWith gains of 261.76% year-to-date (YTD) and 2296.23% post-launch, Injective has shown remarkable growth. Because of its cheap rates and fast speeds, the initiative is attracting more users and projects. Additionally, Injective spends a portion of protocol fees every week, which might lead to a decline in the token's availability and an increase in price.To improve its infrastructure and interoperability, Injective has created a Layer-3 chain on Arbitrum. Using Arbitrum's Orbit toolkit, developers may construct bespoke chains using this Layer-3 development that features the inEVM network. Because to this integration, Injective is now more flexible for developers, since it allows connections with Ethereum, Solana, and Cosmos.Band Protocol is another partner that Injective has teamed up with to improve its ecosystem. The integration of Band Protocol with Injective's inEVM ensures the provision of trustworthy data feeds that are essential for DeFi and derivative applications, among others. With this collaboration, Injective is able to provide more precise and timely data, which greatly improves their skills.Trading at $11.02 above the 200-day simple moving average (SMA) shows that INJ has performed better than its token sale price, which is 127.12% higher.

5.FLOKI 概要:Floki 是另一款以狗为主题的代币,其表现优异,社区支持度高,市值达 20 亿美元。 值得关注的品质: 该生态系统刚刚从 DWF Labs 获得 1200 万美元的融资。 目前市值约为 30 亿美元。 强大的营销团队推动扩张 凭借大量投资和营销支持,Floki Inu 已准备好在市场上持续扩张。