Time:2024-03-21 Click:167

I posted an article last week saying that the market has not yet entered a mad bull market and may pull back, and I was immediately criticized.

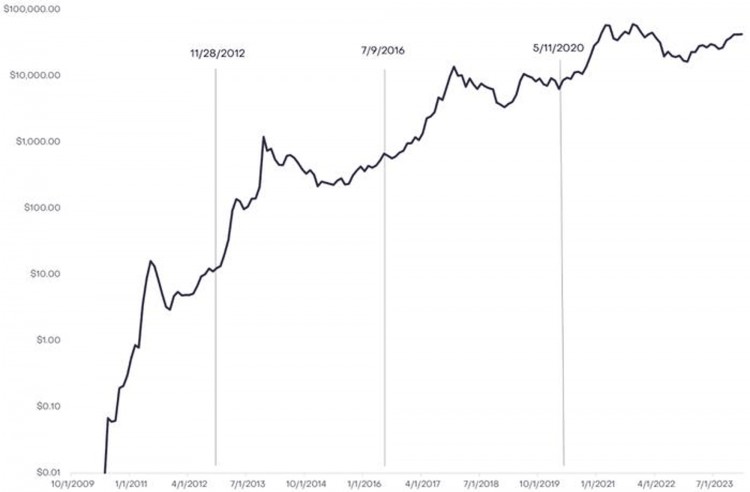

The market proved me right. The picture below shows the price trend of Bitcoin before and after the previous halvings.

Judging from previous cycles, the mad bull market is after the Bitcoin halving.

Before that, due to market speculation about the halving, there would be a correction during the halving.

Today a friend asked me if the bull market is over. ETFs have had net outflows for three consecutive days.

Gua Ge believes that this is a normal correction. The average holding price of ETFs investors is 51,000, with a profit of 35%.

Traditional investors have never seen such a fast way to make money. It is normal to sell at a profit.

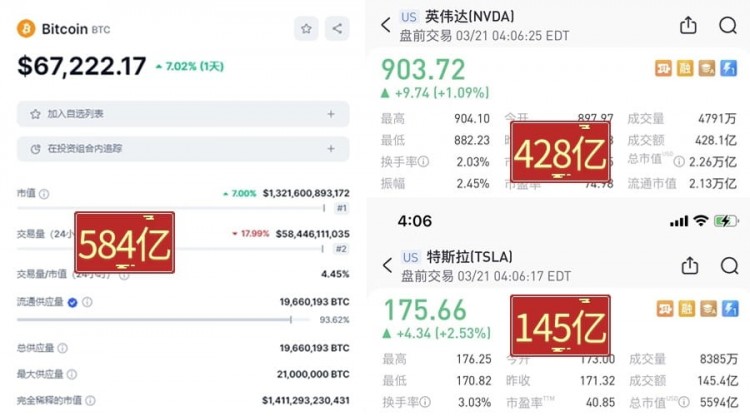

Today’s Bitcoin trading volume is US$58.4 billion, outperforming the two traditional industry giants Nvidia and Tesla

With this kind of trading volume, whoever said it was a bear market? Who am I to worry about?

This morning the Federal Reserve announced that overnight interest rates will remain unchanged

Powell's speech turned dovish, suggesting a rate cut this year. BTC rose 8% in response, recovering yesterday's losses.

Bridgewater, the world's largest hedge fund, recently issued an article saying that there is no obvious bubble among the "Big Seven" in the United States.

Bridgewater has repeatedly predicted that the U.S. economy will have a hard landing and enter a deep recession.

This change is obviously optimistic about the stock market this year.

Technology stocks rise, BTC will inevitably follow suit

Many people don’t believe in on-chain analysis, but study winding theories and K-line charts.

I really don’t understand. The biggest feature of blockchain is decentralization, transparency, traceability, and non-tampering.

When investors bought, how much they bought, when they sold, and how much they earned can all be checked on the chain.

Then why don’t we use this feature to track on-chain data and analyze investor behavior instead of using the stock market approach?

Gua Ge has been in the industry for 7 years and has gone through 3 cycles.

Start studying on-chain data in 2020 and track dozens of cycle indicators

I started buying BTC in August 2023, with a minimum purchase price of 15,500. I don’t know if it counts as a precise bargain hunting.

In addition to cyclical indicators, Gua Ge also tracks several bull market support level indicators.

Today we announce the most effective "short-term holders' cost price index"

In a bull market, whenever the spot price is lower than this indicator, it is the best buying point.

If you don’t believe me, carefully look at the following bull market charts.

Stop bragging

The market has been going up and down in the past two days, and I am exhausted both physically and mentally.

I'm going to go to the SPA downstairs. These girls like it very much.

I don’t know which one to choose.

$BTC #热门话题 #BTC